Sometimes there is such a wide divide between the way news about Greece is presented abroad that you might be forgiven for thinking that perhaps the country is like Slovenia, constantly being confused with Slovakia.

Today the BBC had a lead story that the Greece has fulfilled the conditions for the next installment of the massive 110 billion euro bailout package. To judge from the tone of the article all is well in Athens and now it is business as usual.

The fact that the imposition of the IMF/European Union/European Central Bank measures has crippled the economy seems little more than a perplexing footnote. The reality is that virtually every economic indicator is in the red. Unemployment has risen nearly 50% in just a year, 30 billion euros has been taken out of the country's banking system in the last 12 months and tourism revenue has dropped 25% since 2008.

The Greek Chamber of Commerce is also predicting that over 86% of business are facing liquidity problems and that 100,000 are set to close by the end of the year so further hampering government efforts to raise tax revenue in order to reduce the massive deficit.

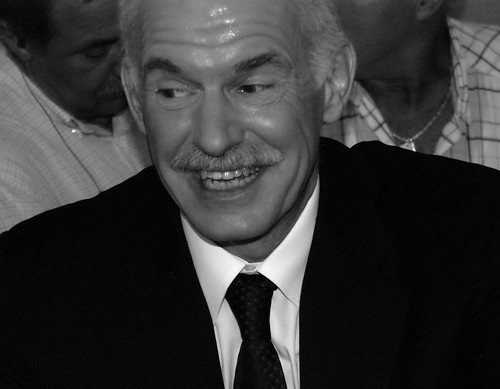

However, unable or unwilling to take on Greece's wealthiest prime minister Giorgos Papandreou has followed the safe path and hiked up VAT twice in th last few months and pushed up fuel prices over 70% since taking power last September. Such tactics are a stark admission of how ineffectual the Greek state is in taxing the country rich directly. As a result the burden of the sacrifices being demanded is falling disproportionately on the shoulders of theworking and middle class.

At first glance such measures could hardly be considered an easy option for any democratically elected government but the fact that PASOK would rather go head to head with millions of bitterly disappointed voters than challenge the wealth and power of the country's richest inhabitants speaks volumes about how much influence they wield in modern Greece.

Sensing the growing outrage over falling wages, rising unemployment and the huge tax increases PASOK is mounting a propoganda campaign to convince the electorate that the better off are also being called up to pull their weight. Day after day the state run channels, along with pro government newpapers and TV stations are reporting raids on clubs and bars evading tax.

The problem is that most Greek have seen such campaigns so often that they are very cynical about their supposed results. Most believe that even if businesses are caught a quick word/bribe to the relevent official means that the case will quietly be dropped once the glare of publicity has moved on.

On the other hand Greece has pointedly ignored the opportunities for clawing back lost revenue squirrelled away in Swiss bank accounts by refusing to act on information that the French and Italian authorities were quick to utilise in their crack down on tax evasion.

Apparently not one of the 1000 plus Greek customers of the Swiss branch of HSBC was worth investigating. In contrast the Italian tax authorities found several cases of wrong doing among the 5728 Italian individuals and companies with accounts.

Whether SDOE (Greek IRS) was right in making such a call is less important than the message it has sent to the public that while they are being crushed by the current austerity program those with access to wealth are not feeling much pain at all. Protected by their off shore companies and close connections with those in power, Greece's elite are quite happy to ride out this crisis in the comfort of their villas and yachts.

The sad irony is that the measure to raise state revenues are not working the, more Athens raises VAT and other indirect forms of taxation the greater the gap is between the amount collected and that needed. Fears of unemployment, falling incomes and rising prices of basic goods such as bread and power means that people have far less disposable income and what money they do have left over is being hoarded in case of future emergencies. With the economy entering a graveyard cycle it is becoming harder and harder to believe that Greece will be able to halt the decline without a radical reapprisal of its current economic priorities.

2 comments:

This is almost exactly the same story as what is happening in the Czech republic, and, I suspect, in most other countries.

Where the rich are investigated, you will probably find that the rich are selectively investigated. Russia has plenty of oligarchs, Khodorkovsky was run in because of his opposition to Putin. How many of those Italian bank accounts were held by Berlusconi's opponents?

This is a global phenomenon and it will stop when the 'big guys' realize that they have to let wealth circulate to actually drive the engines of their economies.

Mass marketing has made technology affordable - including IT, biotechnology and the internal combustion engine. The 'big guys'only get rich when they have something to sell, someone to sell it to and someone with the cash or access to cash to buy it. If they suck up all the wealth like a sponge, then they have no markets for their own businesses.

My thoughts exactly. There is such a huge imbalance in the way that wealth is ditributed that its threateneing the whole economic system.

Post a Comment